Final Pay, Separation Pay and Back Wages: Are They All the Same?

When an employee leaves your organization, they are entitled to receive an exit pay months after they have accomplished their company clearance.

While final pay, separation pay, and back wages are all types of exit pay, they have technical differences which have legal implications that depend on how the employment is terminated. To avoid confusion and future labor issues, let us take a deep dive into the difference of final pay, separation pay, and back wages.

What is “Final Pay” and its components?

According to the Philippine Labor Code, Final Pay refers to the total amount of all the wages or monetary benefits of an employee regardless of the reason for the employment termination. These sum or compensation includes the following but not limited to:

- Unpaid earned salary of the employee

- Cash conversion of unused Service Incentive Leave (SIL) pursuant to Article 95 of the Labor Code;

- Cash conversions of remaining unused vacation, sick or other leaves pursuant to a company policy, or individual or collective agreement, if applicable;

- Prorated 13th month pay pursuant to Presidential Decree No. 851 (PD 851);

- Separation pay pursuant to Articles 298-299 of the Labor Code, as renumbered, company policy, or individual or collective agreement, if applicable;

- Retirement pay pursuant to Article 302 of the Labor Code, as renumbered, if

Applicable; - Income tax claim for the excess of taxes withheld, if applicable;

- Other types of compensation stipulated in an individual or collective agreement, if any; and

- Cash Bond/s or any kind of deposit/s due for return to the employee, if any.

When is “Separation Pay” Applicable?

Separation pay is given to terminated employees due to “authorized causes”. These causes are mainly related to lawful grounds for termination of employment and do not arise from fault or negligence of the employee.

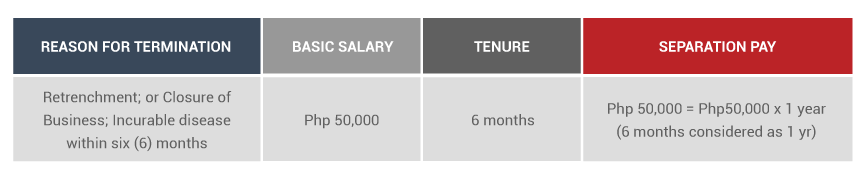

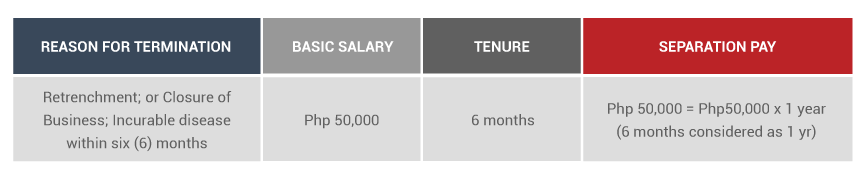

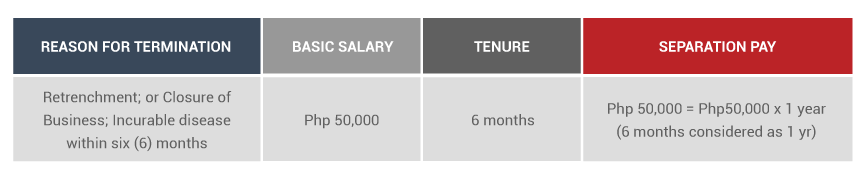

The amount of separation pay depends on the ground for Termination of Employment. It could be either based on ½ or one (1) Month of the Basic Salary, including recurring Allowances multiplied by the number of years in service (a fraction of 6 months considered as 1 year).

To illustrate:

Separation Pay = Monthly Salary x Number of Years in service

Sample 1: Redundancy Scenario

Sample 2: Retrenchment Scenario

*Please note that the Labor Code stated that “In no case will an employee get less than one (1) month separation pay”. Therefore, employees with six (6) months in service and one (1) year will receive the same amount of Separation Pay.

When should we pay “Back Wages”?

Most people are confused with Back Pay and Back Wages since they seem to be literally the same. However, the Labor Code defines it differently.

Back wages is being awarded to an illegally dismissed employee, which consists of his lost income from the erring employer. This also includes all compensations, including allowances and other benefits with a monetary equivalent that should have been earned by the employee but was not collected by him or her because of unjust dismissal. The exact amount will be declared by the Court based on the labor decision.

Understand The Different Post-Employment Wages

Employers should be familiar with the situations wherein the different types of post-employment wages apply based on the reason for employment termination. If you want to learn more about employee exit matters, you may reach out to HR consulting firms to better understand labor-related concerns.

Know More About Post-Employment Wages

Our team of seasoned HR consultants is dedicated to helping you understand labor matters, specifically post-employment wages.